Overview ///

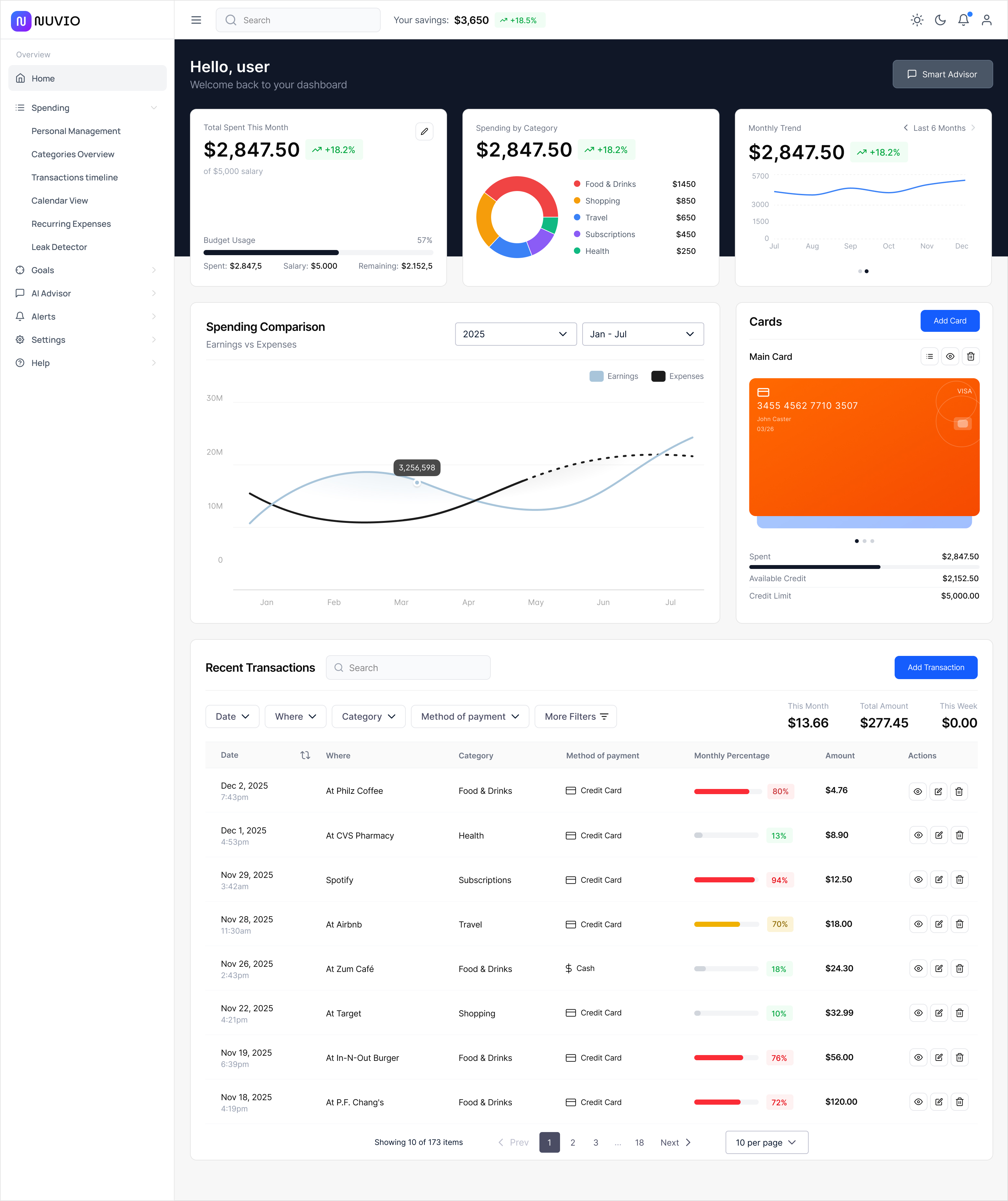

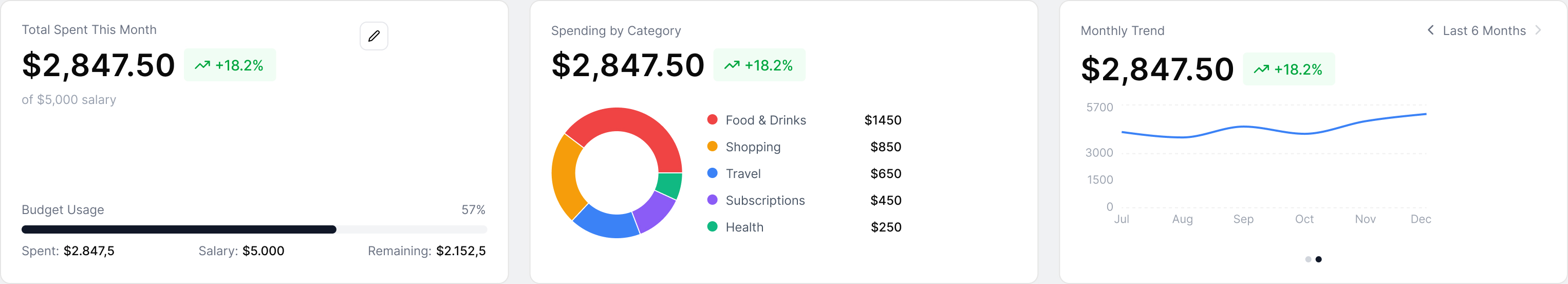

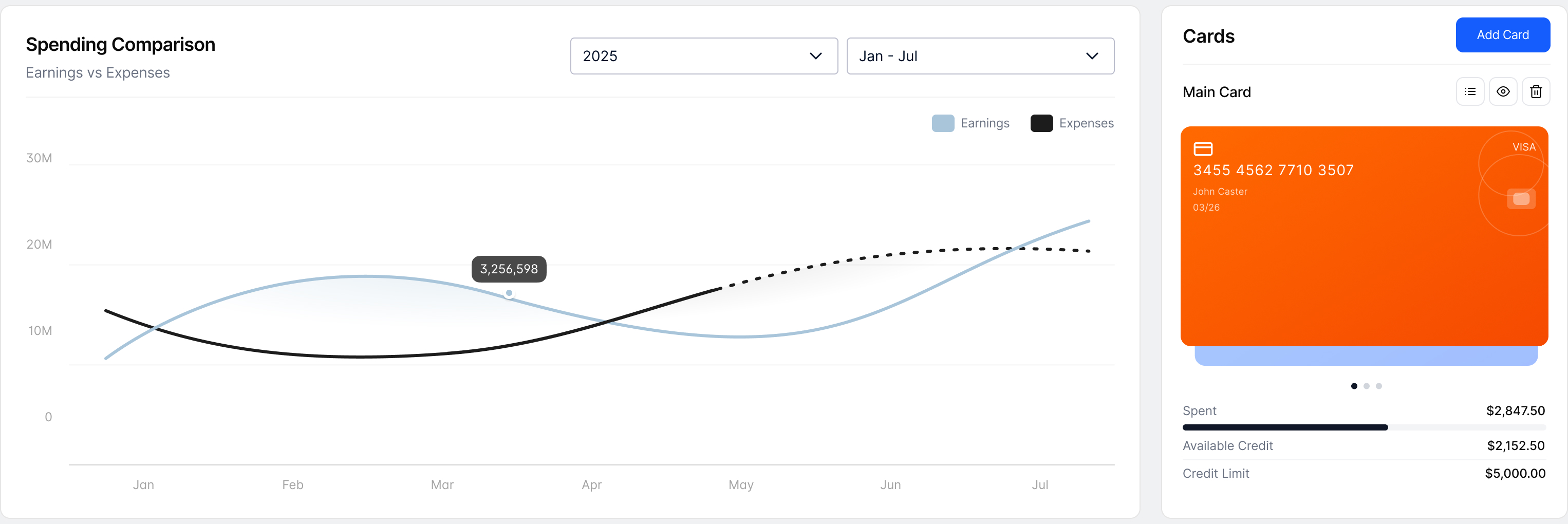

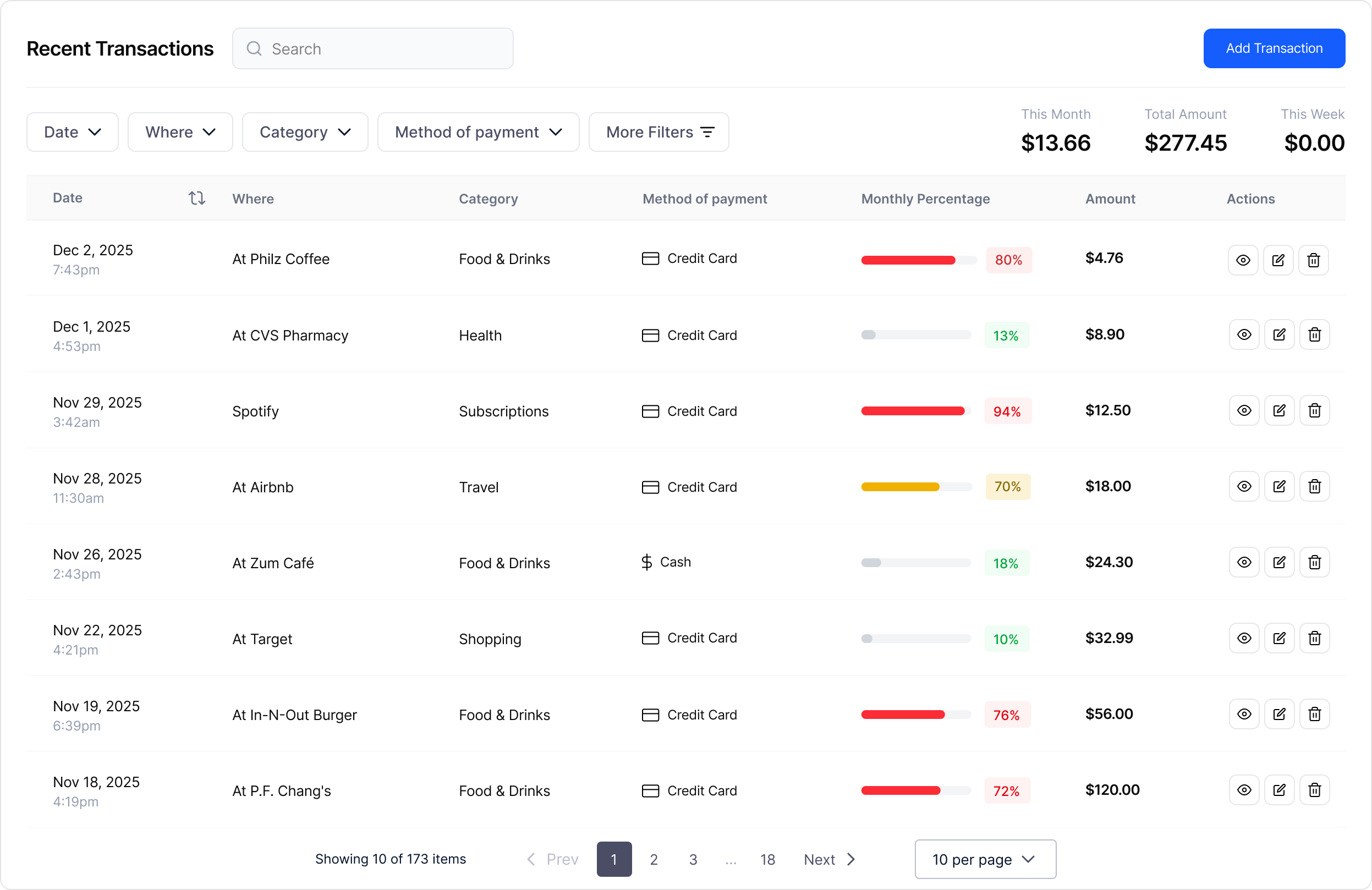

With a strong background in designing dashboards and data-driven interfaces, I saw in this project an opportunity to consolidate my experience into a complete financial management product. This motivation led me to design Nuvio, a personal finance dashboard focused on clarity, data visualization, and decision-making support. Throughout the design process, I analyzed common behaviors found in budgeting and banking apps, identifying friction points related to navigation, data overload, and lack of actionable insights. Based on these observations, I structured a product that organizes financial information into clear layers, prioritizing key metrics, spending behavior, and goal-oriented views. Below, I present the main interface decisions, structural solutions, and UX strategies applied to Nuvio, aiming to transform raw financial data into meaningful, accessible, and decision-driven experiences.

Role ///

UX/UI Design .

Date ///

December 2025